This article is about the changing landscape of consumer protection for building owners in NSW and hopefully soon, in other states. We take a detailed look at initiatives such as latent defect insurance and Project Intervene. We explore how these can assist lot owners dealing with building defects.

Table of Contents:

- QUESTION: More positive steps taken to protect Australian apartment owners as the first Latent Defect Insurance policy is handed over to a NSW owners corporation

- QUESTION: How long will the Project Intervene process take? Is this process quicker than litigation for dealing with building defects?

- QUESTION: What is happening to improve consumer protection for owners and purchasers around Australia? Do you have any timelines for owners located outside of NSW?

- ARTICLE: Changing the landscape of consumer protection

More positive steps taken to protect Australian apartment owners as the first Latent Defect Insurance policy is handed over to a NSW owners corporation

On 4 December 2023, Andrew Ferguson, Managing Director of Coverforce Insurance Brokers, informed us about an important and positive step for consumers in NSW and Australia. Today is a milestone for Latent Defect Insurance (LDI) as the first LDI policy is handed over to a NSW owners corporation. Andrew provides a very quick overview of Latent Defect Insurance and the positive impact this will have on strata ownership in the future. Topics discussed in this short video:

- How does Latent Defect Insurance differ from the 2% bond? What are the advantages to lot owners?

- This type of insurance is compulsory in other countries. Will this occur in Australia? How does this fit into the current changes in NSW?

- Who are the winners and who are the losers?

- If you are looking to purchase an apartment off the plan, what should you be asking?

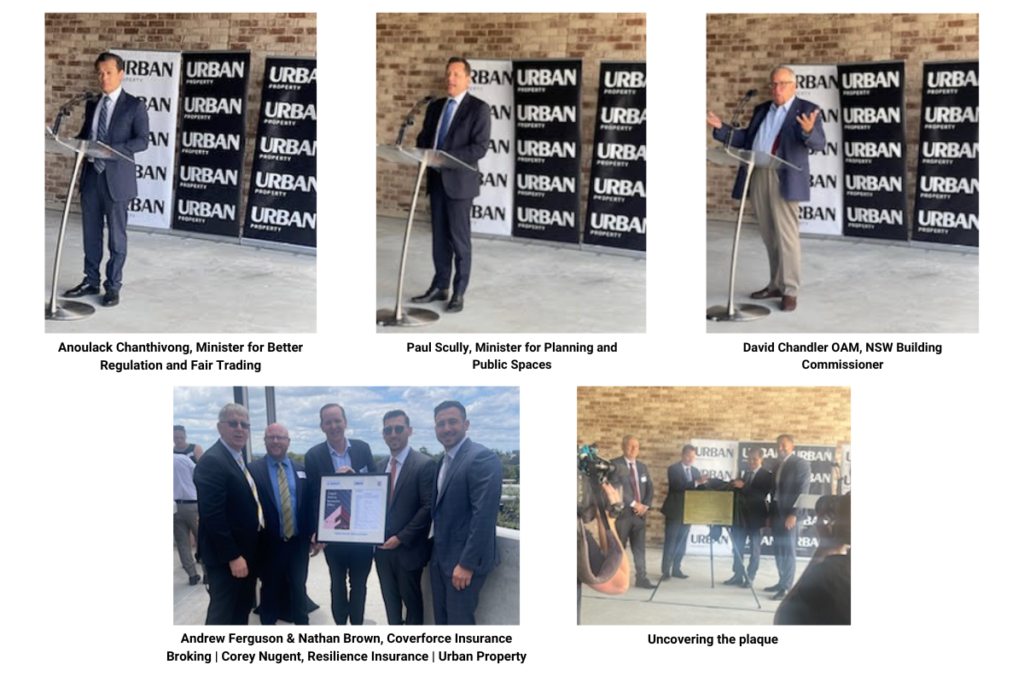

Presentation of the first Latent Building Insurance handed to the owners corporation in NSW

Images provided by and published at the permission of the author.

Is this the beginning of the end of the strata building defects crisis in Australia?

Andrew Ferguson

Coverforce Insurance Broking

E: [email protected]

P: 1-3000-COVER

This post appears in Strata News #675.

Question: How long will the Project Intervene process take? Is this process quicker than litigation for dealing with building defects?

Answer: The Project Intervene process can take up to 3 months, then rectification will follow.

The Project Intervene process involves a site inspection, report and collaboration with the developer / builder to gain a commitment. This can take up to 3 months, then rectification will follow. As the process follows the Residential Apartment Buildings (Compliance and Enforcement Powers) Act 2020 it is a defined statutory process with deadlines, opposed to litigation that historically can run over many years.

Bruce McKenzie

Sedgwick

E: [email protected]

P: 1300 735 720

This post appears in Strata News #642.

Question: What is happening to improve consumer protection for owners and purchasers around Australia? Do you have any timelines for owners located outside of NSW?

Answer: What’s critical in states outside of NSW, however, is the advocacy required from the strata community and from owners.

Corey Nugent, Resilience Insurance:

Many states are working through the regulatory reform process. New South Wales is probably the most exciting and potentially quite a long way down that road with Project Intervene and the Construct NSW platform.

However, iCIRT and Resilience Insurance offer products on a national basis already. A builder developer in Queensland, Victoria, Western Australia etc can access those products. What’s critical in states outside of NSW, however, is the advocacy required from the strata community and owners to ensure governments expand on the reform programme and ensure consumers are protected through similar mechanisms to what we already see in New South Wales. We are speaking with governments extensively. Hopefully, we’ll see some advancement in other states at that level.

Bruce McKenzie, Sedgwick:

We’d like to think that the examples such as Project Intervene in NSW at the moment will create a standard that other states will start to look to and meet.

Morris Mellinger, Sedgwick:

In the coming months, there will be more activity around the country. As builders take up iCIRT and more happens within the development space, and the public begin to demand change, developers will get that message. People will start talking with their feet and move to products that have these stricter processes in place.

Governments around the country are working towards something similar to New South Wales. I think, over the next 12 months, we should start to see some action around Australia.

Bruce McKenzie

Sedgwick

E: [email protected]

P: 0420 961 403

Morris Mellinger

Sedgwick

E: [email protected]

P: 0408 371 353

Corey Nugent

Resilience Insurance

E: [email protected]

P: 0450 862 945

This post appears in the April 2023 edition of The QLD Strata Magazine.

ARTICLE: Changing the landscape of consumer protection

Life comes with unexpected surprises, not all good. The same can be said for the construction industry, frequently plagued by supply chain disruptions, cashflow constraints, labour shortages, cost increases and defective construction. The latter often leaves consumers to pursue contractors on their own, with few options to address these issues, or feeling that costly litigation is their only recourse.

That said, the industry appears to be shifting towards a more consumer-centric market. With over 340,000 strata schemes across the country, owners have the right to expect a quality product.

Better choices, less distress

For the first time in Australia, purchasers have an evidence-based rating to make an informed choice when purchasing a property. The independent construction industry rating tool – iCIRT- helps purchasers know which businesses are best equipped to build quality assets.

Created by Equifax in conjunction with the NSW government, key industry bodies and consumer stakeholders, iCIRT will improve trust and transparency in the construction industry. Trustworthy constructors that attain three gold stars or higher (maximum five) are recognised on a register at iCIRT.

To obtain a gold-rating, constructors must participate in an independent and rigorous review of their entire business. This process rewards those that perform highly while calling attention to those that don’t.

Karen Stiles, Executive Director of the Owners Corporation Network (OCN), confirms they support a simple star rating system to help purchasers make better choices, and reduce the risk of dealing with building defects. To drive proactive change, we need to work together — consumer, industry and government — by investing in and taking advantage of the programs available.

A new era of claims management

High-rise residential strata buildings have been in the spotlight globally, with highly publicised structural failures resulting in assets being condemned, buildings deemed uninhabitable, and even injury and deaths.

In 2021, the NSW building commissioner’s office indicated that 39% of NSW buildings presented serious defects. Extrapolated nationally, that alarming figure would indicate nearly 80% of new apartments could suffer from serious defects.

In response, Resilience Insurance introduced latent defect insurance (LDI). iCIRT-rated developers can earn additional financial benefits, further protecting consumers with a 10-year insurance policy. This could change how Australia delivers quality buildings to consumers.

Corey Nugent, CEO at Resilience Insurance, explains that as one element of recent building industry reforms, LDI drives improved consumer confidence. More importantly, consumers will discover their bargaining power, demanding transparency in the delivery and security of built assets.

LDI provides cover against loss from physical damage arising out of inherent defects within 10 years of the completion date. The cover extends to issues relevant to the structural works and building envelope, including waterproofing.

This is a new era of claims management.

By monitoring performance throughout construction, LDI gives consumers an additional layer of quality assurance, ensuring buildings are constructed to the appropriate standards and comply with design and engineering specifications.

Sedgwick

E: [email protected]

P: 1300 735 720

Have a question about the changing landscape of consumer protection or something to add to the article? Leave a comment below.

This article is not intended to be personal advice and you should not rely on it as a substitute for any form of advice.

Read next:

- NSW: Q&A Capital Works Fund – What Do We Need To Do Now?

- VIC: Q&A Seeking an Order for Works to Proceed

- WA: Dealing With and Selecting Contractors for Your Strata Building

Visit Strata Building Defects OR Strata Topics by State pages.

After a free PDF of this article? Log into your existing LookUpStrata Account to download the printable file. Not a member? Simple – join for free on our Registration page.

Leave a Reply