This article about who to trust with your owners corporation money has been provided by David Lin, Strata Management Consultants.

Good owners corporation management companies are hard to come by and good owners corporation managers even more so

GET NOTIFIED WHEN WE PUBLISH NEW Q&As, NEWS AND ARTICLES TO THE SITE

Working in owners corporation management can be a challenging assignment.

Buildings in 2020 have evolved to become complex entities. The management of these complex entities requires aptitude and knowledge across a multitude of legislation and regulations.

Yet, becoming a registered owners corporation manager in Victoria remains staggeringly simple – it can be achieved in a matter of days.

All that an individual (or a company) has to do is fill out a form and pay a lodgement fee of $206.10 – very much akin to a tale of medical practitioners in the old Wild West. And indeed there has been a plethora of new entrants and arrivals hanging up the shingle and calling themselves owners corporation managers.

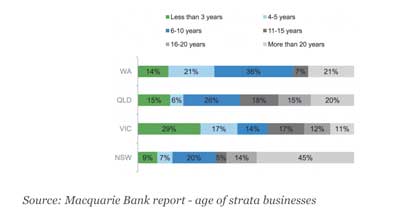

Nowhere else is this more pronounced than in Victoria – an astonishing 29% of registered owners corporation managers are less than 3 years old.

Source: Macquarie Bank report – age of strata businesses

The Ever Growing List

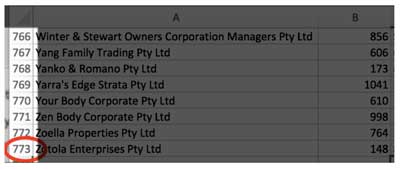

A few years ago, we obtained a copy of the list of registered owners corporation managers from the Business Licensing Authority – that Microsoft Excel list had 773 entries.

The last time we checked (early last year) that list had ballooned to over 1,300 entries.

What is worrying is that the overwhelming majority of these new operators are one-man

bands without any prior strata management experience and/or the accounting smarts to manage the books of owners corporations.

Murphy’s Law – What Can Go Wrong, Will Go Wrong…

Owners corporation managers look after the funds of your building:

- they’re tasked with collecting levies;

- they have authority over your bank account; and

- they make large recurring payments out of your funds for outgoings for the building (as well as deductions for their own fees and charges)

Good small operators are generally those who have stumped the capital to buy an

established business or a franchise, which comes with a few benefits of:

- the prerequisite strata management software;

- processes and procedures; and

- and the embedded intellectual know-how.

An OC Committee we worked with in Q3-Q4 2018 made the mistake of going with a one man band for their large CBD apartment complex…

It would seem the manager was overwhelmed with the volume of payments and receipts, the volume of communications and meetings, resolving building issues, looking after the financials of the owner corporations under management – on top of running his own business… It’s no easy task.

Where It Went Wrong

Then it started – communications slowed, meetings were not being held, and creditors hadn’t been paid. The lift company got in touch and as did the embedded energy provider.

Then one day, the owners corporation manager (quite literally) fell off the face of the planet. Phone calls were not returned. Emails bounced. The books and records of the owners corporation were (and are) nowhere to be found.

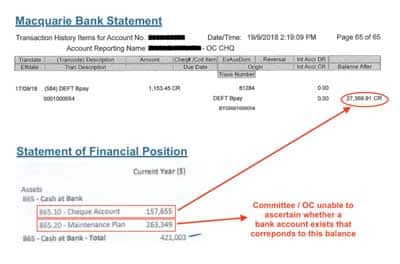

As the Committee dug deeper it would become apparent that the accounting software platform being used to run their building wasn’t one of the established strata software platforms but rather some online generic bookkeeping software.

More alarming still, there was a gross mismatch between the cash at bank reported on the balance sheet and the actual cash at bank per the bank statement.

One of the first thing we did was to ask Macquarie Bank to put a freeze on the owners corporations’ bank account. It’s a case that’s still under investigation and there are a still lot of unknowns – there is no suggestion of any wrongdoing but it does paint a cautionary tale.

What financial checks and balances should Committees be instigating?

- Ask for regular financial statements from the owners corporation manager – we would recommend quarterly financial statements if your OC collects and spends more than $30,000 per annum.

- Review and scrutinise the expenses (all the different line items and the quantum of each of the expenses) on the Profit and Loss Statement.

- Review and evaluate the assets and liabilities of the owners corporation – are there sufficient funds to meet upcoming payments?

- Ask for a bank statement for each and every bank account that the owners corporation has – this includes bank accounts and term deposit statements for both admin and maintenance funds, across all the OC’s.

- Cross-check the cash at bank balances on the balance sheets to the bank statements and term deposit statements

Qualified & Approved Management Companies

As much as Committees should be responsible and oversee what the owners corporation manager is doing there has to be a balance. At some point, Committees should be able to delegate and entrust the management company to do the right thing – that comes with appointing a quality company with proven track record in the first place.

We qualify and vet the companies we work with.

We don’t claim to work with every good manager in town but the ones we work with are pretty good and we stand behind their work.

Not sure if your owners corporation funds are in safe hands?

David Lin

Strata Management Consultants

E: [email protected]

P: 1300 917 848

This post appears in Strata News #346

Have a question about managing your owners corporation money or something to add to the article? Leave a comment below.

EmbedRead next:

- VIC: Q&A Can Our Owners Corporation Manager Charge For this?

- VIC: Q&A Clear Guidelines – Safety Precautions in Relation to COVID-19

Visit our Your Strata Levies OR Strata Title Information Victoria

Looking for strata information concerning your state? For state-specific strata information, take a look here.

After a free PDF of this article? Log into your existing LookUpStrata Account to download the printable file. Not a member? Simple – join for free on our Registration page.

I recently reviewed Financials from our previous Manager. Fictitious charges for water excesses ( leaks) preferential treatment for friends charged to OC.inflatred charges for essential services. Charge should have been 340 pa he charged 1685 for last year and similar charges for previous years.

Did not keep our monies separate., No Bank statements

AGM report stated Owners have reviewed and approved expenses. This did not happen for many years and his friends on committee said nothing!

Abused an owner using AGM minutes for challenging his interpretations of OC ACT

. Made OC liable if this owner sued.

Advised OC not to make an objection to a planning application which would affect their essential light despite section 47 requirements for OC to ensure . Had discussions with developer lodging permit application then advised oC not to object!

Much more. including was not advising of GST charged.Advised OC that an application for rebate required a professional at cost of 2000.Why??

But VCAT takes a year so I accepted his resignation at VCAT pre hearing.

So we have been subjected to fraud for many years due to a compliant committee

SAD